1. Preparing Before Raising Capital

Successful fundraising begins long before meeting investors. Founders focus on refining their business model, validating traction, and building a compelling value proposition. Clear metrics—revenue growth, user engagement, and retention—strengthen investor confidence.

2. Choosing the Right Funding Stage

Startups typically progress through stages such as seed, early-stage, and growth funding. Each stage serves a different purpose—from product development to market expansion. Understanding timing helps founders raise capital without excessive dilution.

3. Building a Strong Pitch Story

Investors back stories supported by data. A strong pitch clearly communicates the problem, solution, market opportunity, business model, and growth strategy. Founders who articulate vision alongside execution stand out.

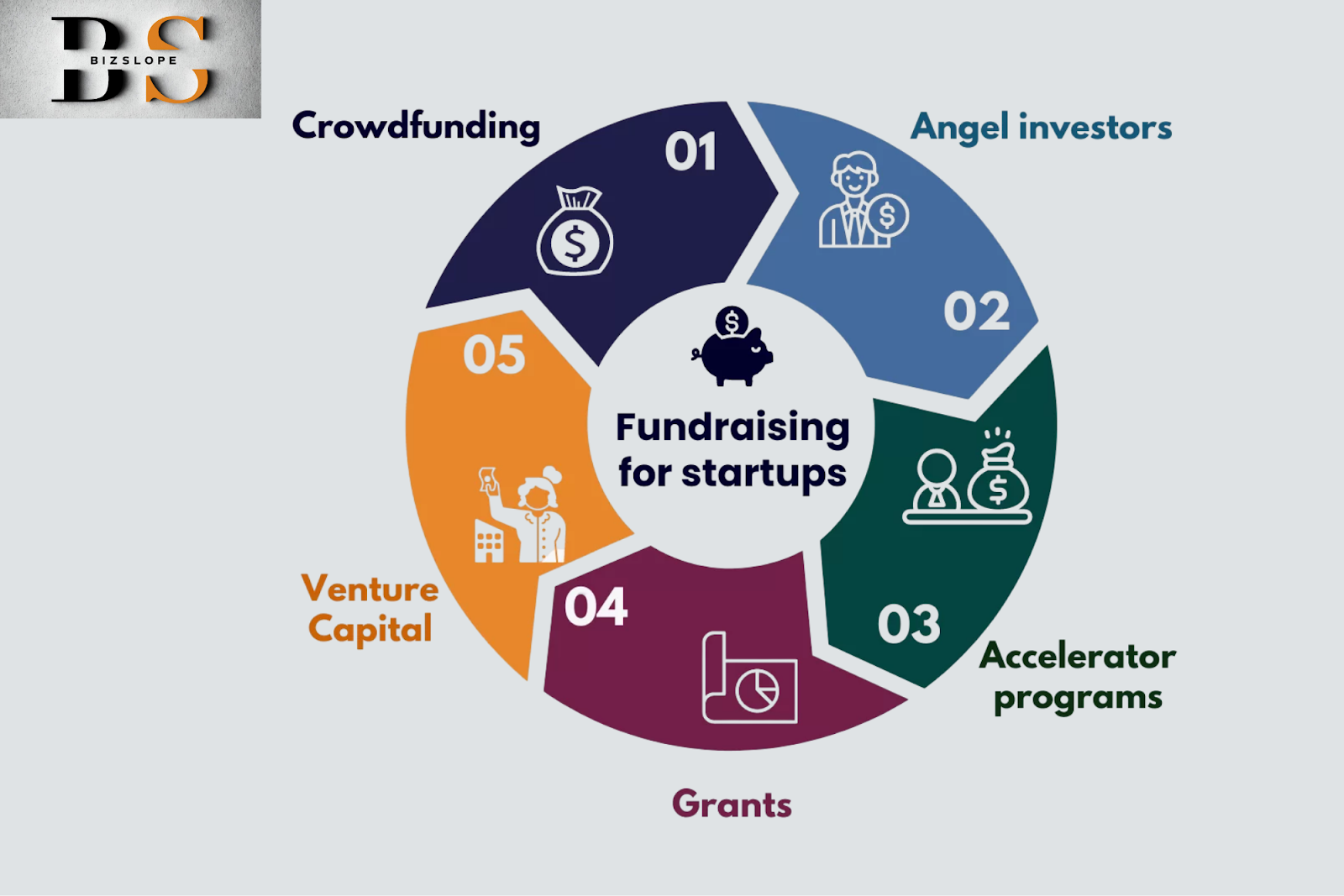

4. Identifying the Right Investors

Not all capital is equal. Growing startups seek investors who bring strategic value, industry expertise, and long-term alignment. The right partners contribute beyond funding through mentorship and networks.

5. Navigating Due Diligence

As interest grows, startups enter due diligence. Transparent financials, legal compliance, and operational clarity are essential. Preparedness at this stage builds trust and accelerates deal closure.

6. Managing Negotiations and Terms

Term sheets define valuation, equity, and governance. Founders must balance capital needs with long-term control and flexibility. Sound legal and financial advice is crucial during negotiations.

7. Using Capital for Scalable Growth

Post-funding success depends on disciplined execution. Startups invest in talent, technology, and customer acquisition while maintaining financial control. Strategic deployment of capital drives sustainable growth.

8. Maintaining Investor Relationships

Fundraising doesn’t end with the deal. Regular updates, transparency, and alignment help build strong investor relationships, paving the way for future rounds.

Conclusion

The fundraising journey is as much about strategy and trust as it is about capital. Startups that prepare well, choose the right partners, and execute responsibly transform funding into long-term growth and impact.